The Bybit Calculator serves as a valuable tool for traders, enabling users to refine their trading strategies based on accurate calculations. The calculator considers crucial factors such as Position Margin, Leverage, Average Entry/Exit Price, and Contract Quantity. Through this, traders can precisely compute Profit/Loss, Target Price and Entry Price.

Here is a guide that outlines the correct logic for effectively harnessing the Bybit Calculator for enhanced decision-making in Perpetual and Futures contracts trading.

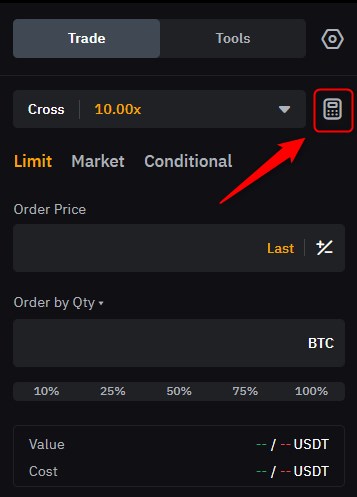

Step 1: Locate the Bybit Calculator at the top right of the Order Zone:

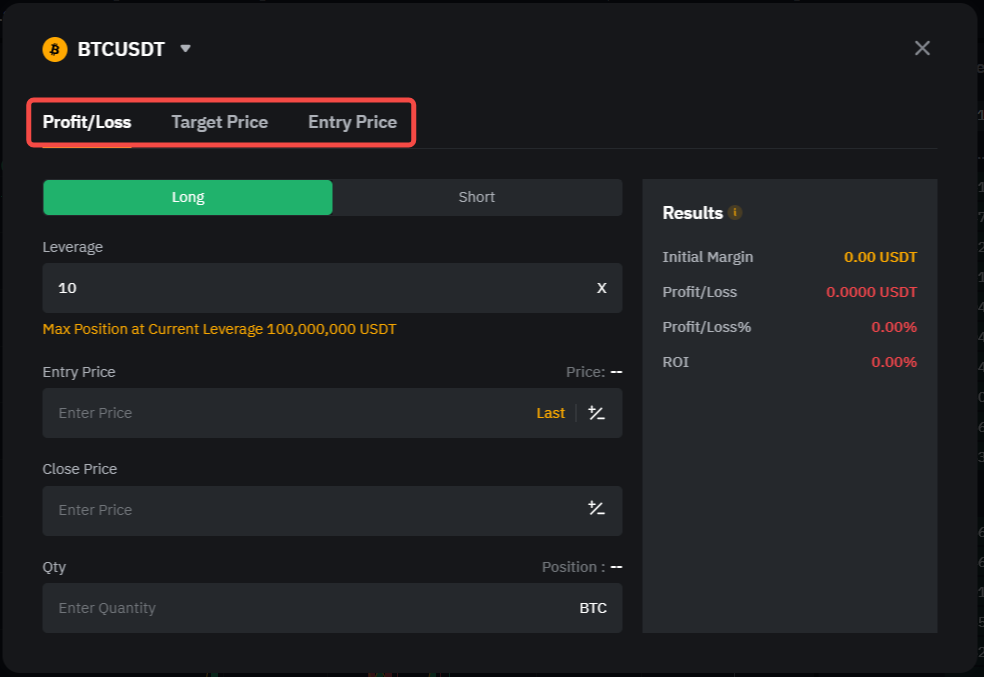

Step 2: Utilize the Calculator to choose from the following calculations:

Please note that trading fees and funding fees are not included in the calculations.

(1) Profit/Loss

Profit/Loss calculation involves determining the position's profit and loss, excluding fees.

You can calculate the Initial Margin, Profit/Loss, Profit/Loss (%), and ROI (Return of Investment) for your position by entering its Leverage, Contract Quantity, Entry price, and Close price.

-

Initial Margin: The required order cost when opening the position

-

Profit/Loss: Profit and loss of the position, excluding fees

-

Profit/Loss (%): Percentage of profit compared to the average entry price of the position

-

ROI: The ratio of return on assets to the initial margin used in the position. Formula: ROI = P&L / Initial Margin

For more details on the initial margin and profit and loss calculations, please refer to the following articles:

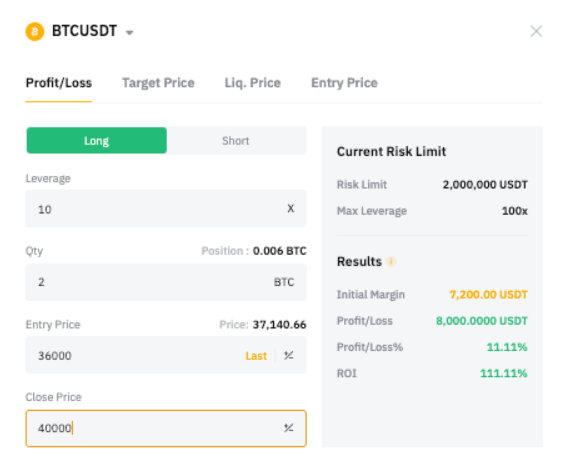

Example

Assuming Trader A buys the Perpetual Contracts with the following parameters:

-

Direction: Buy Long

-

Leverage: 10x

-

Quantity (Qty): 2

-

Entry Price: $36,000

-

Close Price: $40,000

Please note that the contract quantity and average entry price of the existing position can be viewed above the respective trading pair, adjacent to the quantity and entry price fields.

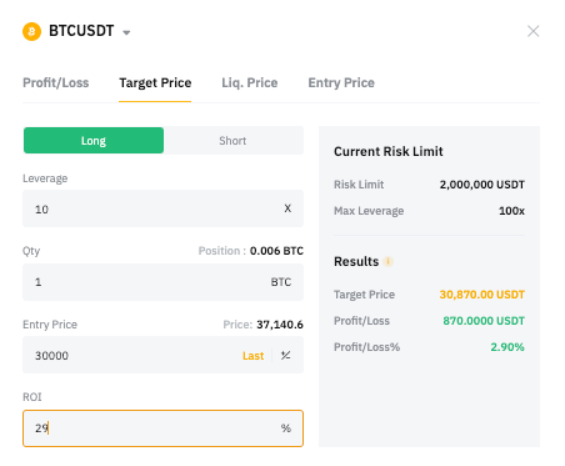

(2) Target Price

Determine the estimated target price to close the position by calculating the rate of return on investment (ROI %) needed, excluding fees.

Example

Assuming Trader A buys the Perpetual Contracts with the following parameters:

-

Direction: Buy Long

-

Leverage: 10x

-

Quantity (Qty): 1

-

Entry Price: $30,000

-

ROI (%): 29

Entering the value above, we can calculate that for the position to reach a 29% ROI, the targeted take profit/exit price should be set at around 7,280 USDT.

Please note that the contract quantity and average entry price of the existing position can be viewed above the respective trading pair, adjacent to the quantity and entry price fields.

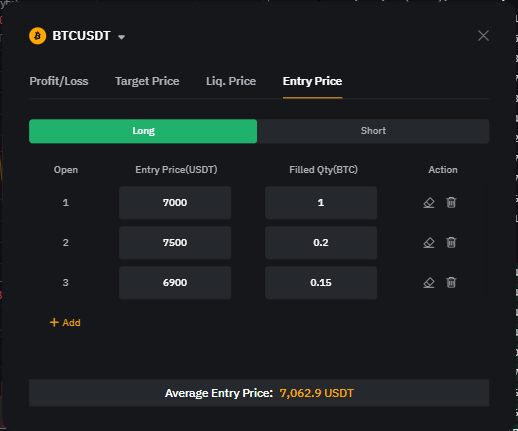

(3) Entry Price

Calculate your average entry price for multiple opening orders.

With these calculation tools, you can easily check the Average Entry Price for your positions. This capability empowers you to make more informed estimates, particularly in assessing the Profit and Loss for your positions.

Example

The current position of Trader A was opened with the following 3 orders:

-

Buy Long, Qty: 1, Entry Price: $7,000

-

Buy Long, Qty: 0.2, Entry Price: $7,500

-

Buy Long, Qty: 0.15, Entry Price: $6,900

Upon entering the set of values in the calculator the Average Entry Price is displayed as 7,062.90 USDT.

For more details on the Average Entry Price calculations, please visit this article.