In margin trading, initial margin is the minimum margin required to open a position. The leverage used by traders directly affects the initial margin. The lower the leverage, the higher the initial margin required. Let's take a look at how the initial margin in USDT perpetual & futures trading is calculated.

Formula

Initial Margin = Position Value / Leverage

Position Value = Position Size × Mark Price

Example

Trader A places a 0.5 BTC contract for $50,000 with 10x leverage. Assuming the Mark price is now $50,500.

Initial Margin = 0.5 × 50,500 / 10 = 2,525 USDT

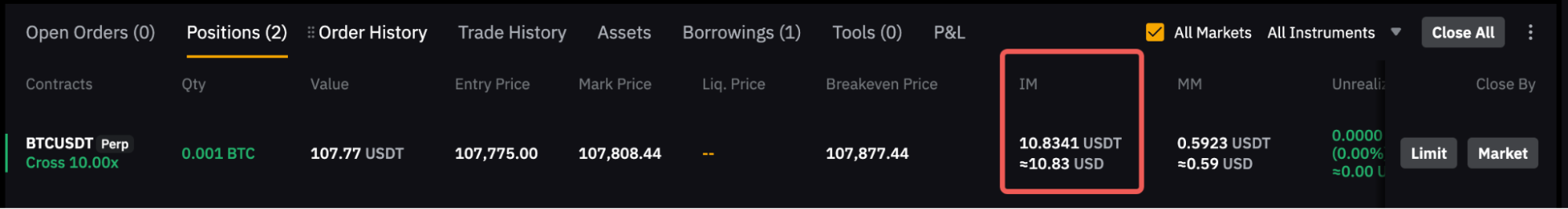

Please note that the initial margin shown in the position tab includes the taker fee, which may be incurred in closing the position.

The estimated closing position fee is calculated slightly differently, depending on the direction of the position — long or short.

Long Positions Formula:

Estimated Fee to Close Position = Position Size × Position Average Entry Price × (1 − 1 / Leverage) × Taker Fee Rate

Revisiting Trader A’s case: Trader A places a 0.5 BTC contract at a price of $50,000 with 10x leverage.

According to the calculation of the above example:

Estimated Fee to close position = 0.5 × 50,000 × (1 − 1 / 10 ) × 0.055% = 12.375 USDT

In this case, the initial margin for the position is (2,525 + 12.375), or 2,537.375 USDT.

Short positions Formula:

Estimated Fee to Close Position = Position Size × Position Average Entry Price × (1 + 1 / Leverage ) × Taker Fee Rate

Revisiting Trader A’s case: Trader A places a 0.5 BTC contract at a price of $50,000 with 10x leverage.

According to the calculation of the above example:

Estimated Fee to Close Position = 0.5 × 50,000 × (1 + 1 / 10 ) × 0.055% = 15.125 USDT

In this case, the initial margin for the position is (2,525 + 15.125), or 2,540.125 USDT.

Important note:

As shown in the initial margin formula, it is calculated as Position Value ÷ Leverage, where Position Value = Position Size × Mark Price. Since the mark price changes in real time, your initial margin also fluctuates. When the mark price rises, your position value increases, which in turn raises the margin requirement. However, if you are in a long position, this will not increase your overall account risk since your unrealized profit offsets the rise in the required margin.