What is Smart Leverage?

Smart Leverage is a non-principal-protected structured financial product that helps users navigate extreme market volatility to place bets in a single direction, maximizing gains with high leverage while mitigating the risk of liquidation before settlement. Smart Leverage offers up to 200x leverage for selected coins and is suitable for traders who are inclined to use high leverage during periods of sharp price reversals.

Key Advantages

-

High Leverage: Amplify your earning potential with up to 200x leverage.

-

No Liquidation Before Settlement: Shield your investment from liquidation risks from subscription to settlement.

-

Early Redemption: Redeem your earnings anytime before the settlement period ends.

Product Terms

|

Breakeven Price |

A floating indicator calculated by the platform. For longs, the breakeven price is always above the entry price. Conversely, for shorts, it is always below the entry price. Once an order is confirmed, the breakeven price will not change. |

|

Current Price |

The current Mark Price of Perpetual contracts. |

|

Settlement Price |

The settlement price is determined by calculating the average of the Derivatives Index Price every second for 30 minutes before expiration. |

How Does Smart Leverage Work?

In standard derivatives trading, a 1% price change can trigger liquidation for positions using 100x leverage.

With Smart Leverage, traders can long or short their desired tokens with up to 200x leverage to amplify potential gains. During periods of extreme market volatility, traders’ initial investment amount will not be affected until settlement.

At settlement, the profit or loss is determined by the settlement price, compared to the breakeven price. The maximum loss is capped at the trader’s initial investment amount.

The PnL scenarios for Smart Leverage longs and shorts are as follows:

|

Direction |

Scenarios |

Calculations |

Outcomes |

|

Long |

Settlement Price ≥ Breakeven Price |

Payoff = Investment Amount + [Investment Amount × Leverage × (Settlement Price - Breakeven Price) / Breakeven Price] |

You will receive your investment amount and the leveraged return. |

|

Settlement Price < Breakeven Price |

Payoff = max (Investment Amount + [Investment Amount × Leverage × (Settlement Price - Breakeven Price) / Breakeven Price], 0) The minimum payoff is 0. |

You may sustain some losses. In the worst-case scenario, you will lose your entire investment amount. | |

|

Short |

Settlement Price ≤ Breakeven Price |

Payoff = Investment Amount + [Investment Amount × Leverage × (Breakeven Price - Settlement Price) / Breakeven Price] |

You will receive your investment amount and the leveraged return. |

|

Settlement Price > Breakeven Price |

Payoff = max (Investment Amount + [Investment Amount × Leverage × (Breakeven Price - Settlement Price) / Breakeven Price], 0) The minimum payoff is 0. |

You may sustain some losses. In the worst-case scenario, you will lose your entire investment amount. |

Let’s look at some numerical examples.

Example

Trader A longs BTCUSDT using Smart Leverage with the following order specification.

Investment Amount: 5,000 USDT

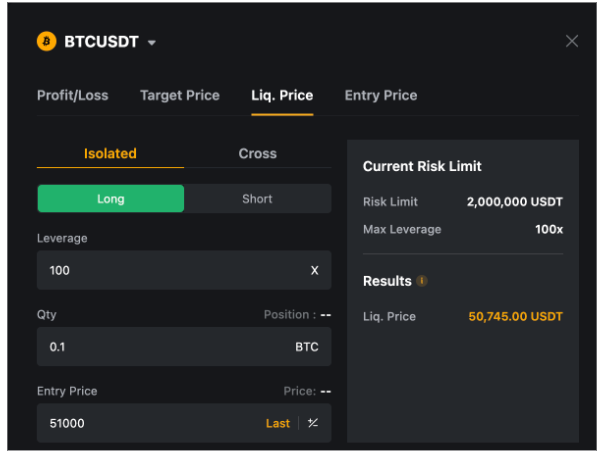

Entry price: 51,000 USDT

Leverage: 100x

For normal derivatives trading, Trader A’s position will likely be liquidated at 50,745 USDT.

With Smart Leverage, Trader A’s investment will not be liquidated before settlement, even with extreme market volatility.

Trader A’s payoff will be determined by the breakeven price. Suppose the breakeven price is 52,000 USDT. These are several possible P&L scenarios at settlement (for illustrative purposes only).

|

Scenarios |

Settlement Price (USDT) |

Payoff (USDT) |

P&L (USDT) | |

|

1 |

BTC plummets |

48,000 |

Payoff = max(5,000 + [5,000 × 100 × (48,000 - 52,000)/52,000], 0) = max(-33461.54, 0) = 0 |

-5,000 (the entire investment amount) |

|

2 |

BTC surges |

53,000 |

Payoff = 5,000 + [5,000 × 100 × (53,000 - 52,000)/52,000] = 14,615.38 USDT |

9,615.38 |

|

3 |

BTC surges to 53k before correcting to the 51k level |

51,800 |

Payoff = max(5,000 + [5,000 × 100 × (51,800 - 52,000)/52,000], 0) = 3,076.92 USDT |

-1,932.08 |

|

4 |

BTC nosedives to 47k before bouncing back to below 53k |

52,500 |

Payoff = max(5,000 + [5,000 × 100 × (52,500 - 52,000)/52,000], 0) = 9,807.69 USDT |

4,807.69 |

Risk

Smart Leverage is an advanced structured product that is not principal protected. If the settlement price falls below the breakeven price, the entire or part of your investment amount will be lost.

Notes

-

Smart Leverage allows traders to either follow the normal settlement timeline, or opt for early redemption.

-

The redemption proceeds from Smart Leverage will be calculated based on the payoff formula at expiration. There might be a slight difference due to market fluctuations but this potential difference will be capped at 0.5%.

- Early redemption will not be possible if the calculated payoff is negative or equal to 0. Additionally, it will no longer be available starting from one hour before settlement.