Bybit offers a range of USDC-settled contracts for traders to choose from, including both USDC Perpetual and USDC Futures Contracts.

USDC Perpetual Contracts are a type of contract that has no expiration date and allows traders to go long or short using USDC as margin.

These contracts are quoted in USDC, with all margin, profit, and loss calculations being settled in USDC. Using BTC-PERP as an example, if a trader holds a 1 BTC contract and the price of BTC increases by $100, the trader's profit will be 100 USDC. This means that regardless of the price fluctuations in BTC, traders can always see their profits and losses in terms of USDC.

Note: Bybit's USDC Perpetual Contracts only support the One-Way position mode, meaning users can only hold either a long or short position in the contract.

USDC Futures Contracts have a set expiration date and allow traders to buy or sell assets at a predetermined price on that future date. Likewise, these contracts are also quoted in USDC and settled in USDC under the Unified Trading Account.

Notes:

— Currently, USDC Futures Contracts can only be traded with a Unified Trading Account (UTA), please upgrade to a UTA to begin trading.

— There are no fees for delivery settlement of USDC Futures Contracts.

— There is no funding fee that will be incurred for USDC Futures Contracts.

— The delivery price is calculated based on the average index price 30 minutes before the delivery time.

— USDC Futures Contract uses the index price of the corresponding Perpetual Contract as its index price.

Read More

8-Hour Session Settlement Mechanism (USDC Perpetual & Futures)

Contract Specifications

USDC Perpetual Contracts (Using BTC-PERP as an example):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: To learn more about the differences between USDC Perpetual Contract and USDT Perpetual Contract on Bybit, please refer to FAQ — USDC Contract.

USDC Futures Contracts

Currently, Bybit only supports BTC and ETH USDC Futures Contracts. The USDC Futures Contracts will be available for trading after 8AM UTC to 9AM UTC on the day of listing.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* On Bybit, the symbol of the USDC Futures Contract is composed of the underlying asset-delivery date. For example, BTC-17MAR23 means that the BTC-USDC Futures Contract settled on Mar 17, 2023 8AM UTC.

Listing Rules

After the weekly contract has been delivered, the bi-weekly contracts will turn into the new weekly contract, while the tri-weekly contracts will become the new bi-weekly. At this point, a new tri-weekly contract will be generated.

Please note that if the delivery date of the monthly contract overlaps with the delivery date of the upcoming tri-weekly contract, the monthly contract will turn into a new tri-weekly contract. The bi-monthly contract becomes the new monthly contract, and a new bi-monthly contract will be generated at this point.

Margin Modes

USDC Perpetual and USDC Futures Contracts adopt the same margin modes: Cross Margin mode and Portfolio Margin mode.

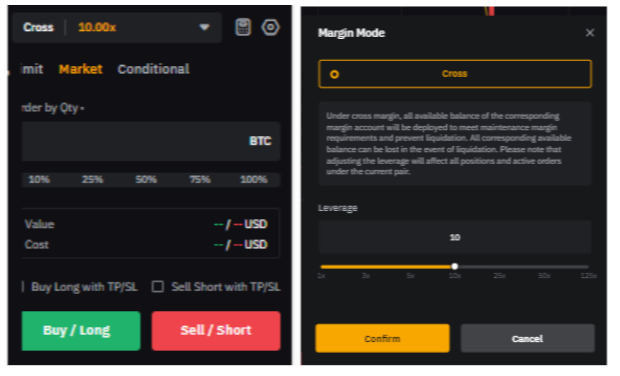

Cross Margin Mode

This is the default mode for trading USDC Perpetual and USDC Futures Contracts.

In Cross Margin mode, all of a trader’s available USDC balance is used to prevent liquidation. When the maintenance margin rate reaches 100%, the trader's leveraged position will be liquidated. For more details about the liquidation process, please refer to the Liquidation Process (USDC Contract).

Users can set their preferred leverage in the order zone. Please note that 10x is the default leverage.

Portfolio Margin Mode

Portfolio Margin aims to align the margin requirements with the overall risk of the portfolio. It combines the positions of the Perpetual and Options portfolios to calculate the user’s utilized margin.

Portfolio Margin accounts offer the following potential benefits for traders who maintain a balanced portfolio of hedged positions:

-

Lower margin requirements

-

Increased leverage

To enable Portfolio Margin, your account needs to meet the following requirements:

-

Maintain a minimum net equity of 1,000 USDC

-

There are no open positions in your USDC Derivatives Account

-

There are no active orders or conditional orders under your USDC Derivatives Account

For more information, please refer to Margin Calculations under Portfolio Margin.

Notes:

— Portfolio Margin is a risk-based margin applicable to qualified accounts, and requires manual activation by users.

— In Portfolio Margin mode, if the net equity in your account is less than 1,000 USDC, one of the following two situations will apply:

1) If there are no open positions or active orders in your account, the system will automatically revert to Cross Margin mode.

2) If there are open positions or active orders in your account, your account will still remain in Portfolio Margin mode.

To switch between Cross Margin and Portfolio Margin modes, please click the margin mode button above the order zone.